Content

These two asset‐account entries offset each other, so the accounting equation remains in balance. Since the cash balance was $50,000 before this transaction occurred, the company has $20,000 in cash after the equipment purchase. Suppose a new company obtains a long‐term loan for $50,000 on August 1. The company’s cash account increases by $50,000, so it is debited for this amount. Simultaneously, the company’s notes payable account increases by $50,000, so it is credited for this amount. Both sides of the accounting equation increase by $50,000, and total debits and credits remain equal. The reason this equation works as an error check is because of the double-entry accounting method.

Is double entry bookkeeping hard?

Double-entry bookkeeping is one of the commonest stumbling blocks that accounting students face on the road to qualifying. Most experienced accountants would agree that it’s difficult to get your head around double-entry when you first start out.

Single-entry bookkeeping is very similar to personal bookkeeping, like keeping a checkbook. Transactions are coded using the chart of accounts which then feed into the financial reports that reveal how your business is doing. Some research credits the Jewish traders who acted as intermediaries between Muslim and Roman Empires in early medieval times. However, others believe the double-entry accounting was developed much earlier in Korea during the Goryeo dynasty (918 – 1392). Read on to learn more about why we use this accounting system, and how it’s used to balance a company’s books.

What Is The Difference Between Single Entry And Double

Then record each transaction with the date, description, and amount. Parentheses indicate outflows and non-bracketed numbers are inflows. At the end of the accounting period, just calculate the remaining balance. Basically, double-entry provides a 360 degree view of a business’s financial transactions, making financial reporting smoother and operations more transparent. Double-entry has been around since the Renaissance era and perhaps even before.

Chart of Accounts: Definition, Guide and Examples – NerdWallet

Chart of Accounts: Definition, Guide and Examples.

Posted: Tue, 12 Oct 2021 07:00:00 GMT [source]

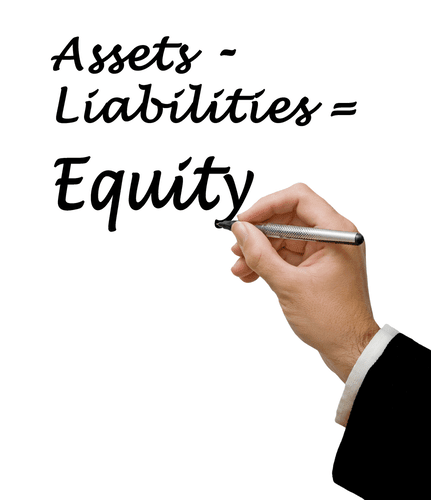

Every entry in an asset account is balanced by an entry in a liability or equity account. Thus, if assets don’t equal liabilities plus equity, you know you have a problem. Double-entry bookkeeping is an accounting system in which all financial transactions are recorded in two types of accounts, debits and credits. When you post a transaction, the number of debits and credits used can be different, but the total dollar amount of debits must equal credits. Double entry accounting is a record keeping system under which every transaction is recorded in at least two accounts. There is no limit on the number of accounts that may be used in a transaction, but the minimum is two accounts.

The Top 25 Tax Deductions Your Business Can Take

Additionally, most lenders require GAAP-compliant financial statements when evaluating loan applications from any private or public company. In the following example, suppose you’re a business owner recording the debit and credit entries for all of the transactions that take place in a week. For example, a copywriter buys a new laptop computer for her business for $1000.

In single-entry bookkeeping, you maintain a cash book in which you record your income and expenses. Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses. After you factor in all these transactions, at the end of the given period, you calculate the cash balance you are left with. Accountants and bookkeepers can do a small business’s double-entry bookkeeping. Or FreshBooks has a simple online accounting solution that lets small business owners do it themselves and makes keeping the books easy.

A Brief Reminder: Accrual Vs Cash

In this case, the asset that has increased in value is your Inventory. Because you bought the inventory on credit, your accounts payable account also increases by $10,000. Credit accounts are revenue accounts and liability accounts that usually have credit balances. With a double entry system, credits are offset by debits in a general ledger or T-account. At this point, we’ve covered the philosophy of double-entry accounting and the accounting equation.

Two characteristics of double-entry bookkeeping are that each account has two columns and that each transaction is located in two accounts. Two entries are made for each transaction – a debit in one account and a credit in another. Single-entry bookkeeping is characterized by the fact that only one entry is made for each transaction, just like in your check register. In one column, entries are recorded as a positive or negative amount. In single-entry bookkeeping, you can actually keep a two-column ledger, one column for revenue and one for expenses. It’s still considered single-entry because there is just one line for each transaction. However, businesses have to keep a detailed accounting of their financial transactions.

Which Is Appropriate For Your Small Business?

Debits will increase an asset account or decrease a liability account. Larger businesses have taken advantage of double-entry accounting software for decades. It is a necessity given the complexity and volume of their business. When choosing accounting software, companies should look for features such as real-time data access, advanced analytics tools and accelerated closing processes.

What is double entry accounting examples?

Double-entry bookkeeping is an accounting system where every transaction is recorded in two accounts: a debit to one account and a credit to another. For example, if a business takes out a $5000 loan, assets are credited $5000 and liability is debited $5000.

When you generate a balance sheet in double-entry bookkeeping, your liabilities and equity (net worth or “capital”) must equal assets. This failsafe tells businesses if their journal entries are wrong. Double-entry accounting is aimed at providing a system of checks and balances that can show whether your bookkeeping system accurately reflects your company’s financial situation. For example, if you’ve entered all of your transactions accurately, then the sum in your accounting system’s cash account should match the actual amount of cash that you have available. For a business that uses the cash method of accounting along with a double-entry bookkeeping system, taxable sales should also correspond with cash on hand minus outgoing revenue.

Verify With The Trial Balance

However, a simple method to use is to remember a debit entry is required to increase an asset account, while a credit entry is required to increase a credit entry. If you’re a new business or a very small business, you might use single-entry bookkeeping to manage your transaction data. However, if your business finances have complexities like accounts receivable or accounts payable, you’ll likely default to double-entry bookkeeping. And if you’re using accounting software of any sort, that software will automatically run on the double-entry system. For example, a business owner buys new furniture for the business for $1000.

- The total assets should always equalize the liabilities and equity of a business.

- Joe can tailor his chart of accounts so that it best sorts and reports the transactions of his business.

- There are other terms – such as common share, ordinary share, or voting share – that are equivalent to common stock.

- However, if your business finances have complexities like accounts receivable or accounts payable, you’ll likely default to double-entry bookkeeping.

Bookkeeping can be complicated businesses of any size, and double-entry bookkeeping, all the more so. Here’s a closer look at this financial process and how understanding double-entry bookkeeping can help your organisation. For each transaction, the total amount debited must equal the total amount credited.

Expense accounts detail numbers related to money spent on advertising, payroll costs, administrative expenses, or rent. Common stock is a type of security that represents ownership of equity in a company. There are other terms – such as common share, ordinary share, or voting share – that are equivalent to common stock.

As you said, double entry accounting does not apply to central banks. But single entry accounting would suffice.

— Chow🥂 (@chow_global) November 26, 2021

The normal balance in such cases would be a debit, and debits would increase the accounts, while credits would decrease them. Once one understands the DEAD rule, it is easy to know that any other accounts would be treated in the exact opposite manner from the accounts subject to the DEAD rule. Outside of simply memorizing the above lists, making debits and credits takes practice. Over time, you’ll see that some accounts have natural relationships between them.

Double‐entry Bookkeeping

One is a debit to the accounts receivable account for $1,500 and a credit to the revenue account for $1,500. This means that you are recording revenue while also recording an asset which represents the amount that the customer now owes you.

- Looking for the best tips, tricks, and guides to help you accelerate your business?

- A debit is always on the left side of the ledger, while a credit is always on the right side of the ledger.

- While double-entry bookkeeping does not eliminate all errors, it is effective in limiting errors on balance sheets and other financial statements because it requires debits and credits to balance.

- This article compares single and double-entry bookkeeping and the pros and cons of both systems.

- Start with your existing cash balance for a given period, then add the income you receive and subtract your expenses.

From the general ledger, you can derive a trial balance that is made up of the sum of all the nominal accounts. The trial balance has both a debit and credit side that are equal to each other. Credits are recorded on the right side of a T account in a ledger. Credits increase balances in liability accounts, revenue accounts, and capital accounts, and decrease balances in asset accounts and expense accounts. Debits are recorded on the left side of a ledger account, a.k.a. T account. Debits increase balances in asset accounts and expense accounts and decrease balances in liability accounts, revenue accounts, and capital accounts.

If the two sides of this equation are out of balance, this is a good sign there’s an error in the books. If bookkeeping errors go undetected, you may be making decisions based on faulty information. double entry accounting That could lead to bounced checks or bank charges further down the road. The entry is a debit of $10,000 to the cash account and a credit of $10,000 to the notes payable account.

By using double-entry accounting, you can be sure all of your transactions are following the rules of the accounting equation. Putting all this double-entry bookkeeping data together will form a trial balance and the financial statements. In practice, using a double-entry accounting system quickly becomes second nature.

Author: Roman Kepczyk